INFLATION

Level and volatility

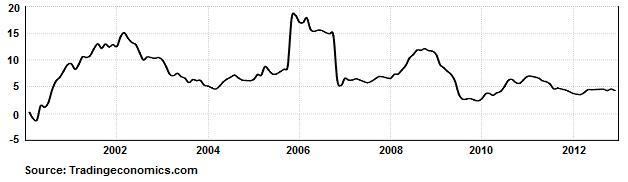

of Indonesia's inflation rate have historically been higher than some

peer emerging nations. While these other countries share inflationary

rates of between three and five percent during the period 2005 - 2012,

Indonesia contains an average annual inflation rate of around 8.5

percent during the same period. There is, however, a more moderating

trend visible since 2009 (see graphic below).

Indonesia Inflation Rate (annual percentage change on consumer price index)

Peaks in Indonesia's inflation

volatility correlate with administered price adjustments. Energy prices

(fuel and electricity) are set by the government and therefore do not

float according to market conditions, meaning that the resulting deficit

has to be absorbed by subsidies. This puts serious pressure on the

government's annual budget deficit and also limits public spending in

more long-term productive matters, such as infrastructure

and social expenditures. Moreover, rearranging energy subsidies implies

political risks as social unrest emerges inflicted by inflationary

pressures. One characteristic of Indonesia is that a large quantity of

its population is clustered just above the poverty

line, meaning that a relatively minor inflationary shock can push

them below that line. When the Susilo Bambang Yudhoyono administration

decided to reduce its massive fuel subsidies in late 2005 due to the

rising international oil price, it soon led to double-digit inflation

rates of between 14 and 19 percent (year on year) until October 2006.

Furthermore, the country's core inflation has been volatile as well

because of second round effects of energy price adjustments that pass

through to the broader economy (for example through rising

transportation costs).

Reduction of energy subsidies is

currently still high on the government's agenda. In early 2012 the

government proposed a fuel price increase but social unrest and

political opposition in parliament made a sudden increase impossible.

Indonesia's current inflation outlook is highly influenced by the

decision to reduce these subsidies. The World Bank estimates that an IDR

1,500 increase in fuel prices can add 3.2 percentage points to the

level of headline inflation and can add 1.3 percentage points to core

inflation.

The table below presents Indonesia's

recent performance and near-future projections regarding inflation

(these projections are based on the scenario with no reduction in energy

subsidies).

The table below presents Indonesia's

recent performance and near-future projections regarding inflation

(these projections are based on the scenario with no reduction in energy

subsidies).

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Inflation (annual percent change) |

9.8 | 4.8 | 5.1 | 5.4 | 4.3 | 5.5¹ |

Source: World Bank

Indonesia's characteristic volatility in

inflation rate causes an usually larger deviation from the annual

inflation projections. The consequence of such inflationary uncertainty

is that it creates economic costs such as the country's current higher

(domestic and international) borrowing costs than its emerging market

peers. When a track record of meeting inflation targets is

established, greater monetary policy credibility will follow.

The lack in quantity and quality of Indonesia's

infrastructure also entails robust economic costs. This hampers

connectivity in the archipelago, thereby increasing transportation costs

for services and products. Distribution disturbances due to

infrastructure-related issues are frequently reported and made the

government realize the importance of more investments in the country's

infrastructure. Infrastructure has been labelled a top priority in the Masterplan

for Acceleration and Expansion of Indonesia's Economic Development

(abbreviated MP3EI); an ambitious long-term government development plan

which is yet to bear fruit.

Food prices are traditionally highly

volatile in Indonesia and subsequently impose a big burden on the poorer

households who live under or just above the poverty line. These

households spend more than half of their total expenditure on food

items. Higher food prices therefore cause serious poverty basket

inflation which may lead to increases in the level of poverty. Failing

harvests in combination with a slow reaction of the government to

substitute food products with food imports are causes for inflation

peaks.

The Ramadan or fasting month (the ninth

month of the Islamic calender) usually constitutes a peak in inflation.

This is a normal phenomenon in other countries with large Muslim

communities as well. A marked increase is visible in spending on food

and other consumables, accompanied by retailers adjusting their prices

upwards.

The current strength of Indonesian

domestic demand (domestic consumption accounts for around two thirds of

the country's economic growth), robust private sector credit growth and

business access to credit can lead to inflationary pressures in 2012 and

beyond. Public sector wages have increased due to administrative

reforms and private sector wage growth has accelerated in the

agricultural and mining sectors (and the minimum wage in Jakarta has

been raised by 40 percent in late 2012). In combination with the

anticipated reduction in energy subsidies, it is likely that

inflationary pressures will rise.

Bank Indonesia (BI), Indonesia's central

bank, has as main objective to ensure rupiah stability. It uses a wide

range of instruments to stem mounting inflationary pressures in the

country. Its bank rate policy is adjusted when inflation targets are not

met. Since June 2009 the central bank rate has been steady between 5.75

and 7.0 percent (constituting a historic low) as targets were met. The

spikes in headline inflation since 2009 have mainly been caused by

weather conditions that resulted in bad harvests, thus being temporary

disruptions only. Another BI measure to tighten monetary policy was the

raising of the reserve requirements on both local and foreign currency

deposits at Indonesian banks. Lastly, BI curtailed foreign investors'

demand for Central Bank bills (SBIs) by extending the required holding

period from one to six months, stretching the maturity of SBI issues to

nine months and by introducing longer maturity non-tradable term

deposits (which are available to banks only). These measures aim at

mitigating the flow of 'hot money' into Indonesia.

Bank Indonesia's Inflation Targets

| 2012 | 4.5% (±1%) |

| 2013 | 4.5% (±1%) |

| 2014 | 4.5% (±1%) |

| 2015 | 4.0% (±1%) |

Indonesian Inflation in World Perspective

The table below puts Indonesia's recent

inflation performance (annual percent change) in global perspective by

comparing it to inflation figures from the United States (USA) and

China.

| 2009 | 2010 | 2011 | 2012 | 2013 | |

| USA | -0.4 | 1.6 | 3.2 | 2.1 | - |

| China | -0.7 | 3.3 | 5.4 | 2.6 | - |

| Indonesia | 4.8 | 5.1 | 5.4 | 4.3 | 5.5¹ |

Tidak ada komentar:

Posting Komentar